Swank v0.04.04

Attachments:

20110728_defaultqa_graphic-popup.jpg

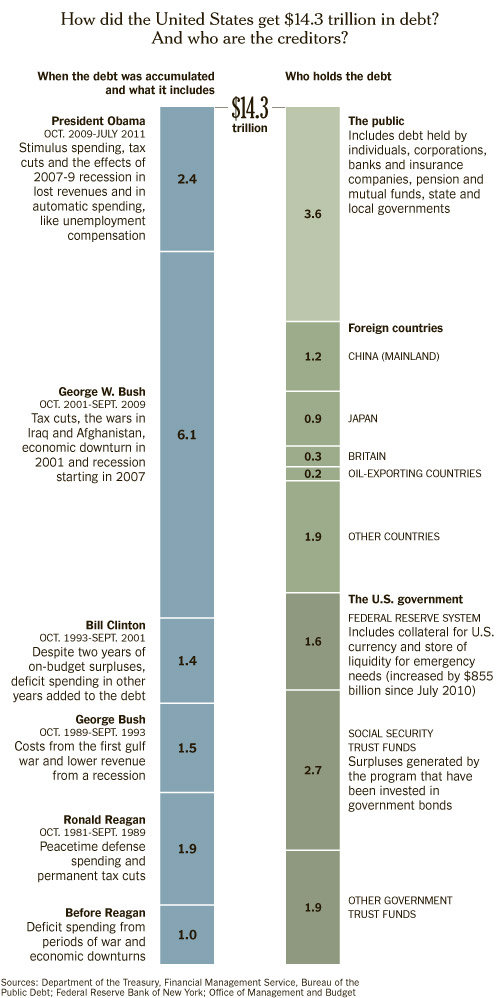

Debt

Debt vs. Deficit

Debt-based economy

Effects of inflation or deflation

Bonds

Most debt is acquired by governments by selling bonds. Bonds are a promise to pay back the principle (price of the bond) plus interest at a later date. On the secondary market, bond prices may fluctuate if there are more sellers than buyers, forcing sellers to sell at a discount, or more buyers than sellers, allowing sellers to ask a higher price. This is often expressed at an interest rate which compares the actual selling price to the bond's yield at maturity. If the market loses faith that the bond will be paid back, there will be much fewer buyers, which forces sellers to offer a large discount, which is expressed in market terms as a high interest rate. These risky bonds are called both "high yield bonds" and "junk bonds".